Rosland Capital

11766 Wilshire Blvd STE 1200

Los Angeles, CA 90025

Products Available:

In this Rosland Capital review, we take a look at the business, its offerings, what we liked, what we did not like and whether we would or would not use it to invest in gold or a gold-backed IRA.

Who is Rosland Capital?

Founded in 2008 Rosland Capital is a relative newcomer to the world of precious metals investing. Despite its youth, the company’s CEO, Marin Aleksov, lends a little bit of credibility to the whole establishment with his 20 years of professional experience in the precious metals industry.

The company maintains its headquarters at Santa Monica, California and has already been endorsed by celebrities such as Bill O’Reilly, G. Gordon Liddy, and actor William Devane (who stars in the company’s landing videos on its website).

Rosland Capital has also been heavily advertised on radio and TV shows.

What Does Rosland Capital Offer?

As with any gold investment company, Rosland Capital hinges on the fact that gold, as well as other precious metals, has a more stable financial value compared to paper-based investments like stocks, treasury bonds, and mutual funds.

Gold stands up pretty well against inflation, and will always hold a high value no matter what the current economic conditions are.

In light of this knowledge, companies like Rosland Capital allows people to back their IRAs with gold and other metals, so as to maintain their value throughout the years and preserve wealth.

Rosland Capital offers a wide selection of bullion, bars, coins and premium numismatic collectibles to choose from. However, its important to be aware that not all metals are eligible in a precious metals backed IRA such as numismatic coins.

Things To Like About Rosland Capital

1. Excellent delivery time

Rosland takes pride in its ability to deliver their clients’ metals within 10 days. Some people even managed to receive their purchases in a lesser time-frame than what the company advertises.

2. Expert economist on staff

Aside from the company’s bevy of celebrity endorsers, Rosland also has an expert economist on their side. Jeffrey Nichols, advises both the company’s management and its clients, and also serves as a writer on the company’s official newsletter.

He suggests that 10 to 15% of an individual’s assets should be held in physical gold.

Things NOT To Like About Rosland Capital

1. Agents are dishonest

When looking at the reviews posted by previous clients you will find that there are lots of disgruntled customers who are angry at the dishonest service by some of Rosland Capital’s agents. They reported being charged excessively high commission rates as well as being subject to deceptive sales tactics.

2. High number of complaints

There has been an unusually high number of complaints posted on the Better Business Bureau and the Business Consumer Alliance websites.

Some of these complaints include false advertising, slow shipping and customers reporting being charged for metals that were way beyond market price.

3. Shared storage

When investing with Rosland Capital your precious metals will be placed in shared storage with other investors. Other companies offer segregated storage options for their clients who don’t want their metals mixed with others’, but sadly, Rosland does not have this option.

Rosland Capital – IRA Fees

| Initial Setup Fees | $50 |

| Annual Admin Fees | $225 |

| Annual Storage Fees | Not Disclosed |

| Minimum Purchase Amount | $10,000 |

| Preferred Depository | Delaware Depository |

Rankings, Complaints and Customer Reviews

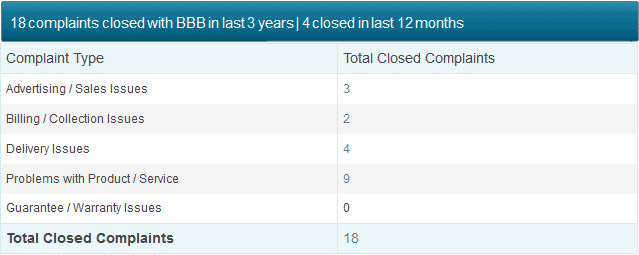

Better Business Bureau (BBB)

|  |

Rosland Capital has received an A+ rating from the Better Business Bureau. Currently there are 18 complaints that have been closed, with most of them regarding problems with their products and service. (read more).

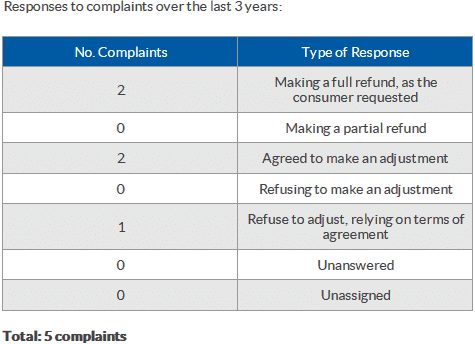

Business Consumer Alliance (BCA)

| AAA |

BCA rates Rosland Capital with an AAA. Again an acceptable rating, but there are 5 complaints that were logged against the company in recent times. Most were about the undervaluation of clients’ holdings (read more).

TrustLink

| |

Based on the reviews of Rosland Capital posted on TrustLink by customers, the company received a 4 out of 5 star rating.

Looking deeper there were many complaints about the company selling its clients overpriced coins. The overall consensus from these customers were to stay away from doing business with them.

Ripoff Report

There have been 6 complaints reported at Ripoff Report since 2010. These complaints highlight the company’s use of deceptive practices to sell overpriced coins for excessively high commission rates.

Rosland Capital Review – Final Thoughts

Is Rosland Capital a scam? Legally, no. But the overwhelming negative sentiment against the company online is a huge red flag that no one should ignore.

Before risking your wealth and retirement money with Rosland Captital, make sure to research this company thoroughly. There are other gold investment companies who wouldn’t dabble in the dishonest business practices that Rosland engages in, such as the false advertising, rude agents and pressure sales tactics that have been reported by customers.

Our Recommendation

Best Service

- Fees Waived with Minimum IRA

- Get 10% Back in FREE Silver

- Editor Rating

- Rated 3 stars

- Good

- Rosland Capital

- Reviewed by:

- Published on:

- Last modified:

- Quality

- Pricing

- Support

You should leave politics out of your advertisement commercials. I was considering your company at one time to invest in gold and silver but thanks to your new commercial I would rather pan for my gold in smarties before I would ever consider you oh and poor choice of a spokes person in your commercial.

What politics?

The dude said to vote he didn’t say who to vote for sounds like you’re a triggered liberal

About 12 years ago I bought some coins from Rosland. I’m in a position today to buy a material quantity of 1 oz bullion coins. I dialed the number on their website entitled “contact” and the person I spoke to was incredibly rude IMHO. I am the chairman of a financial services co. and a 35 year Wall St. legal veteran. If I had been offered this man’s call on a recording to review, I would have asked him to be fired.

I purchased ~$9,900 in coins, mostly silver in 2011, after being hounded (multiple phone calls) by RC that it was a great time to purchase silver and gold. Gold and silver were nearing an all time high and I was leery of purchasing coins in that environment. However, I finally gave in to their sales pitch (which was dishonest)and removed $10,000 from my savings and purchased the coins.

The purchased coins cost $9,900 and their current value after 11 years $4,600 (the amount RC would purchase them back at). If I had let my money set in the investment at 4%, I would have made $3,600.

Yes, the coins devalued (gold/silver prices dropped), but I was assured on the purchase that it takes about 5 years to pay for the RC’s commission. I’ll never even break even on this purchase. That should tell you whether or not to deal with this group. Don’t think for an instant, that RC purchased the coins at the height of the gold/silver and therefore made little on the sales, they bought low and sold high.

Live and learn I guess.

Larry, I spent $10,000 to buy what I thought would be the equivalent amount of gold at the time of purchase less the amount of fees. What I received 8 coins total weight of 2 oz. They tell me the coins will increase in value. So now I am in the coin market not the gold market. Like you say Live and learn.

Rosland Capital the biggest crooks selling gold, silver, coins.

My bad, their bad too, no repeat business !!! How stupid are they. I bought more gold elsewhere… !

Use the gold to buy a time share.

Beware! The annual storage fee for $10,000 in gold and silver is $250.00. This amount is not disclosed! Very dishonest company!

Wish I had read this first

Me Too.

I bought $50,000.00 in gold coins from Rosland 5 years ago. Since that that time the stock market is up over 8,000 points and gold is up over $800.00 an ounce. However, I’m told my $50K investment is now worth $45K. Talk about them selling overpriced coins.

It took me two years, no exaggeration, to find out what my account was worth. No wonder they were reluctant to inform me with that kind of pathetic performance!

I don’t know about buying gold.. But I got a gold IRA… Right off the bat I lost over 20,000. Plus it costs me over 400$ a year for them to hold my account.. Please do NOT get a Rosland IRA… You will loose you money… Gold has went up over 500$ a oz since I got this and I still haven’t broke even..run…

Rosland Capital is a bait and switch scam. I am down 30% on my purchase through Tannis Yamamoto. A total crook.